Ardagh Metal Packaging S.A. - First Quarter 2024 Results

Published April 25, 2024

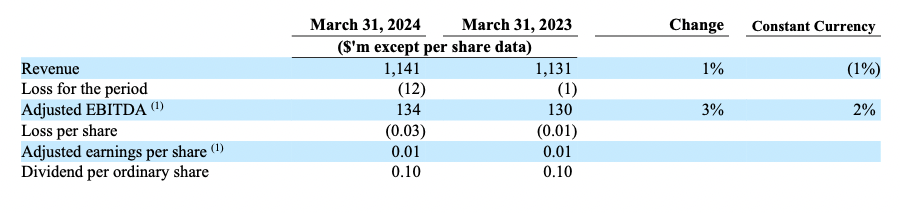

Ardagh Metal Packaging S.A. (NYSE: AMBP) today announced results for the first quarter ended March 31, 2024.

Highlights

Oliver Graham, CEO of Ardagh Metal Packaging (AMP), said:

“Our performance in the first quarter was encouraging, with volume growth across each of our markets and Adjusted EBITDA growth that was marginally ahead of expectations, due to favorable volume/mix. We saw continued strong shipment growth in the Americas, and Europe is showing welcome signs of a recovery post customer destocking, supporting our expectation for Adjusted EBITDA growth in both regions this year. Our disciplined permanent capacity actions have taken effect and our expectation for continued volume growth and increased manufacturing activity will drive improved fixed cost absorption. This gives us confidence to reaffirm our full year guidance and we expect higher Adjusted EBITDA growth for the remaining quarters.”

- Global beverage can shipments grew by 7% in the quarter, driven by strong growth of 11% in the Americas and 3% in Europe. North America grew by 13%, underpinned by its attractive portfolio mix and contracted new volumes. Brazil grew by 4% as the industry continues to benefit from an improving macro environment.

- Adjusted EBITDA of $134 million for the quarter was marginally ahead of our guidance and represented a 3% increase versus the prior year quarter.

- Americas Adjusted EBITDA for the quarter increased by 12% to $91 million driven by favorable volume/mix effects, partly offset by higher operating costs.

- In Europe Adjusted EBITDA for the quarter decreased by 12% to $43 million, as anticipated, principally due to higher input and operating costs, partly offset by positive volume/mix and currency effects. Expect a return to Adjusted EBITDA growth in the second quarter.

- Total liquidity of $329 million at March 31, 2024 was ahead of expectations principally through inventory management. Cash outflow in the period reflects seasonality. Reiterate expectation for a modest net working capital inflow in 2024 and for growth capex to reduce to approximately $100 million, with a further reduction anticipated in 2025.

- Modest deleveraging anticipated in 2024 through Adjusted EBITDA growth and lease principal repayments, with a more meaningful reduction thereafter.

- Regular quarterly ordinary dividend of 10c announced. No change to capital allocation priorities.

- 2024 outlook reaffirmed: shipments growth approaching mid-single digits % and full year 2024 Adjusted EBITDA in the range of $630-660 million.

- Second quarter Adjusted EBITDA expected to be of the order of $170 million (Q2 2023: $151 million reported and constant currency basis).

-

H!GHEND wins two CanTech awards

Ardagh Metal Packaging’s H!GHEND can for Alhambra Reserva 1925 has been awarded the CanTech Grand Tour Award in the Ends category at the CanTech The...

-

Colourful communities in Brazil

In late July 2024, a Municipal School in Jacareí, São Paulo, received a vibrant makeover thanks to a partnership between PPG and AMP, with support f...

-

International Day of Education 2025

Now up and running in more than 40 Ardagh communities on three continents, Ardagh for Education has engaged more than 650 schools, upskilled more than...

-

Zug colleagues visit local nursery

Colleagues from our Zug, Switzerland office visited the Visoparents Foundation nursery school before the festive break. The visit enabled them to lear...